how to set up a payment plan for california state taxes

A payment plan is an agreement with the IRS to pay the taxes you owe within an extended timeframe. If you already filed or youre unable to find this option in TurboTax you can apply for a payment plan at the IRS Payment Plans and Installment Agreements webpage make sure youve filed your return before applying through their site.

This could potentially save you from additional penalties and interest.

. For more information visit our Payment Plan page. How to Setup a Payment Plan Step 1 Agree to Terms Step 2 Create a Payment Agreement Step 3 Begin the Payment Schedule Step 4 Release the Debtor Payment Agreement. As part of the IPA application process taxpayers can request a term andor specific monthly payment amount.

Please allow us 60 days after the tax due date before you follow up with us regarding your request. If you qualify for a short-term payment plan you will not be liable for a user fee. Step 1 Visit IRSgov and click the link for your state.

If your payment plan is approved you will receive a payment plan confirmation by mail within 14 days of our processing your. E-file and E-pay Mandate for Employers. California state tax rates are 1 2 4 6 8 93 103 113 and 123.

Once logged in select Payments then bills and notices and then Request an Installment Payment Agreement Generally this method is if you owe 20000 or less. You can also set up a payment plan. The process to establish your payment plan request in our system will take approximately 60 days after the tax filing deadline traditionally April 15 however there are times when the deadline can be extended.

Or give them a call. E-filing your California state return gets you the fastest refund and reduces errors. Pay Plan Request Forms can be faxed to the Collections Department at.

On June 30 2022 to set up a payment plan 2017 5 2022. File and Pay Options. E-Services for Business is the fast easy and secure way to manage your employer payroll tax account online.

Businesses typically have to repay what is due within 12 months and have to pay a 50 installation fee. Please follow the link below Apply online. Find out about the different ways you can make payments.

Click Leave IRS to proceed to your states department of revenue or taxation. Get the Payment Plan Request for INDIVIDUAL INCOME CM-15 here. View solution in original post.

You should request a payment plan if you believe you will be able to pay your taxes in full within the extended time frame. Choose the payment method. Payments made while on the payment plan are not refundable.

Once you get in the top option is Estimated Tax Payment Form 540-ES Then the FTB will ask you to go through the confirming information. The same applies to businesses whose tax debts exceed 10000. Here is a list of our partners and heres how we make money.

A payment plan is a way for someone to pay for something over a specified length of time. As an individual youll have to pay a 34 setup fee which will be added to your balance when you set up a payment plan. You can do this online through the State of California Franchise Tax Board.

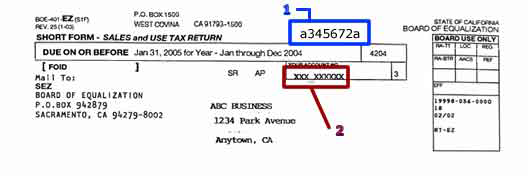

Your payment options include drawing from your bank account credit card check money order or electronic funds withdrawal. Step 2 Click Individuals or Personal to navigate to the appropriate section of the website. Make sure to check if it is a joint or single account.

Sample What is a Payment Plan. You can apply online once you set up an account. Pay Plan Request Forms can be emailed to.

What Are My Payment Options. In 2022 the deadline to file your 2021 taxes is Apr. After that five-year mark our office has the power to sell the property at our annual property tax sale according to state law.

The state typically gives a taxpayer three to five years to pay a balance once a California income tax payment plan has been granted. Payroll Taxes for Your Business. The taxpayer may still make full or partial payment on the taxes.

To do so you will need to file Form 9465 Installment Agreement Request and Form 433-F Collection Information Statement. Step 3 Locate a link for payment arrangements. Your payment options depend on your total tax liability.

When deciding whether or. You can find all the information and resources you need related to filing paying and managing your payroll taxes for your business. When You Can Setup a Payment Plan Taxes owed will become certified after the original assessment from the Department of Taxation expires which is generally 60 days.

If you cannot pay your total past due amount now you can request a payment plan and pay down your balance over time. Select the installment payment plan option Continue and follow the onscreen instructions. Not paying your taxes when they are due may cause the filing of a.

A 1 mental health services tax applies to income. And even if youre afraid you wont be able to afford paying your taxes its better to file and set up a. Payment Plans at California Franchise Tax Board.

However interest and penalties will accrue if the taxpayer fails to pay the balance in full. If your case is in a pending Offer In Compromise it is highly recommended to make monthly estimated tax payments at least until your settlement is done. For example if you owe the IRS more than 25000 you may only pay using direct debit.

For example if you defaulted on your taxes on June 30 2017 you would have until 5 pm. Navigate to the website State of California Franchise Tax Board website. Enter Mailing Address Information Click on Validate Mailing Address.

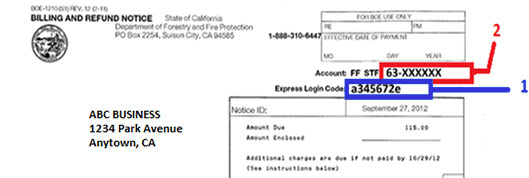

To submit your request locate your User ID and password or Express Login code and bank account information.

Free California Payroll Calculator 2022 Ca Tax Rates Onpay

Living On The Wild Side Skirt Showpo Trendy Tops For Women Floral Print Tankini

Irs Form 540 California Resident Income Tax Return

Yoins Women S Online Clothes Shopping Fashion Clothing Inspired By The Latest Fashion Trends From Mobile Mobile In 2021 Promotional Events Witcheries How To Apply

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

California Property Tax Calculator Smartasset Com Income Tax Property Tax Paycheck

Understanding Your W 2 Controller S Office

California State Taxes 2021 2022 Income And Sales Tax Rates Bankrate

What Is Casdi Employer Guide To California State Disability Insurance Gusto

California Use Tax Information

How To Find Top Adsense Keywords To Boost Earnings Good Paying Jobs Self Made Millionaire Home Buying

Can T Pay Your Taxes An Installment Agreement May Work For You How To Apply Tax Income Tax

Irs Form 540 California Resident Income Tax Return

California Income Tax Returns Can Be E Filed Now Start Free

Should You Be Charging Sales Tax On Your Online Store Sales Tax Tax Filing Taxes